Too Much Information, Too Little Attention: The Retail Reset for 2026

By Len Wierzbicki, Head of Strategy and Marketing, Badger Technologies

Retail has never had more data than it does today.

And store execution has rarely felt harder.

That is the tension many retailers are carrying into 2026.

Over the past several years, the industry invested heavily in systems, analytics, and automation designed to improve performance. Those investments created unprecedented visibility into inventory, pricing, promotions, and store conditions.

Yet inside stores, familiar problems persist.

- Out-of-stocks still surprise teams.

- Pricing errors still reach the shopper.

- Displays still drift.

- Store leaders still spend too much time reconciling what systems say with what the sales floor is showing them in real time.

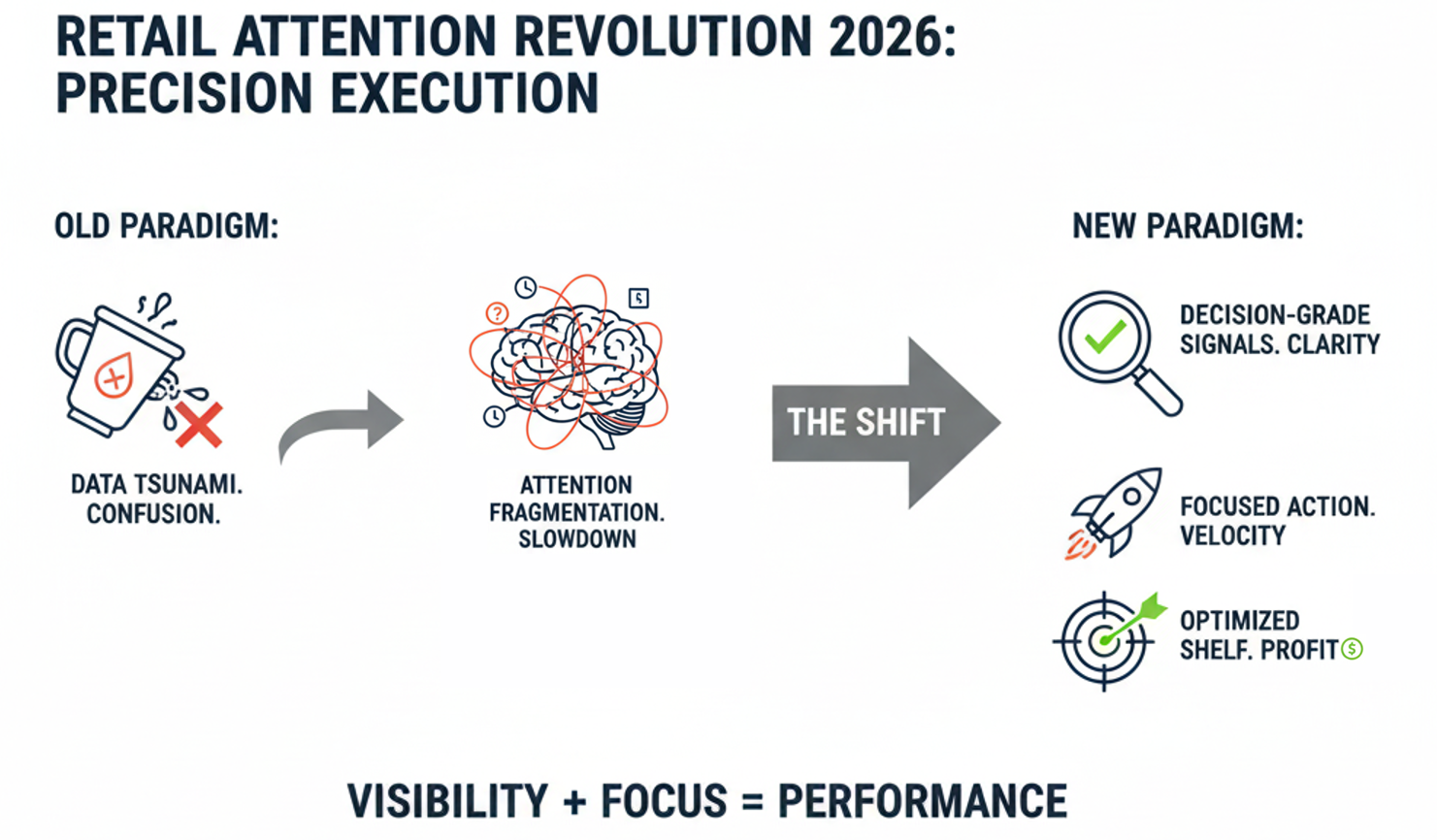

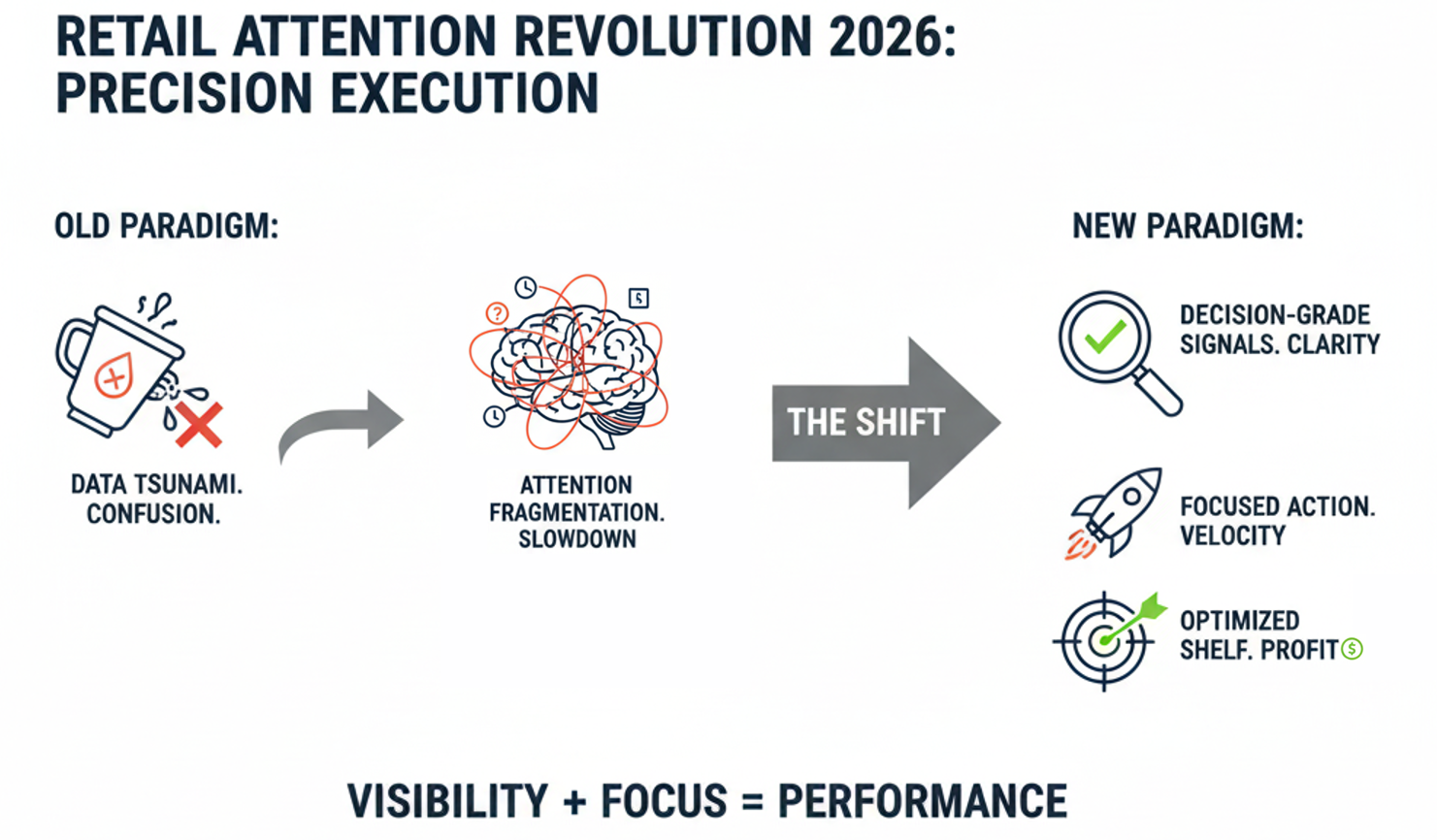

The challenge is no longer access to information.

The challenge is attention.

Execution slows when attention is spread across too many competing signals, especially when teams are unsure which signals reflect reality right now.

When More Information Stops Improving Execution

Spend time with store and operations teams and a consistent pattern emerges.

Issues are identified quickly, but action slows as teams sort through what is urgent, what is reliable, and what can realistically be addressed first. Out-of-stocks are flagged, but not always acted on immediately. Pricing discrepancies are spotted, but linger longer than expected. Exception lists grow longer, and stores feel like they are reacting to everything without fully winning on the most important things.

The result is not inaction. It is delay.

Associates double-check before committing time. Managers investigate before redirecting labor. Leaders debate which numbers to trust before making decisions that will be judged at the register, on the aisle, and in the shopper experience.

This is what happens when the cost of being wrong is high and confidence is low.

The Hidden Cost of Verification Drag

One of the most expensive forms of work in retail is rarely labeled. It is verification.

Verification work appears when teams cannot fully trust what they are seeing. Associates walk the floor to confirm system counts. Managers compare multiple reports before deciding where to deploy labor. Leaders spend time reconciling conflicting views of performance rather than addressing the causes of variance.

This creates what I think of as verification drag. It is the operational slowdown that occurs when organizations have information but lack the confidence to act on it.

Verification drag rarely looks dramatic. It shows up in minutes.

- A few minutes to confirm an out-of-stock.

- A few minutes to recheck a price update.

- A few more minutes to validate whether a gap is real or simply a shelf execution issue.

Across a store fleet, those minutes become hours. Across weeks, they become a structural constraint.

When verification drag increases, execution capacity shrinks. Teams do not become less committed. They simply spend more of their day proving what is true instead of improving what is true.

Attention Is Now the Constraint

Retail once competed on access to information. That era is over.

In most retail organizations today, information is abundant. Alerts, dashboards, and reports update continuously. The challenge is no longer producing insight. It is preventing the flow of insight from overwhelming decision-making.

This matters because stores do not operate in stable conditions. Availability changes throughout the day. Prices update. Seasonal sets shift. Displays move. Customers create disruption simply by shopping.

When attention is fragmented, maintaining consistent execution becomes increasingly difficult.

In 2026, attention becomes the limiting factor.

Not because teams do not care, but because they are asked to react to too many signals at once without enough clarity about what matters most right now.

Dreams Versus Objectives Inside the Store

Retail aspirations are clear.

- Perfect availability.

- Flawless pricing.

- Consistent execution across every aisle.

- Safer stores.

These are worthy goals. But stores do not operate on aspirations. They operate on objectives.

Objectives convert ambition into action. They help teams decide what to do first and what can wait, based on what will have the greatest impact on the shopper and the business in the near term.

✔️ Fix the out-of-stocks that will lose trips today.

✔️ Correct the pricing errors that will create checkout friction.

✔️ Address safety risks before they become incidents.

The difference between dreams and objectives is not ambition. It is discipline.

When objectives are unclear or too numerous, store managers are forced into constant triage. Everything feels urgent. Firefighting becomes normal. Execution becomes reactive rather than deliberate.

A retail reset for 2026 requires more than new tools. It requires operating discipline that protects attention and reduces noise.

A Decision-Grade Signal Test for 2026

If attention is the constraint, leaders need a higher standard for what earns it.

A useful discipline for 2026 is this: treat every alert, report, and insight as guilty until it proves it can drive action.

Here are five questions leaders can use to separate decision-grade signals from noise:

- Is it true right now?

- Does it reflect current store conditions rather than yesterday’s state or a system assumption?

- Can a store team act on it immediately?

- If action requires multiple additional checks, it is not yet a signal. It is the start of more verification.

- Does it tell teams where to start?

- If it produces long lists without priority, it increases cognitive load instead of reducing it.

- Does it reduce debate or create debate?

- Signals that spark argument slow execution.

- Does it connect to shopper impact?

- If it does not change what the shopper experiences at the shelf, it may have analytical value but limited operational value.

Signals that consistently pass this test deserve attention. Signals that fail may still belong in reporting, but they should not drive day-to-day execution.

Why the Shelf Becomes the Reference Point

One of the most important implications of this shift is where retailers go to determine what is true.

The shelf is where the shopper experience is realized. Availability, pricing, placement, and presentation converge in a physical space that often diverges from what systems assume is happening.

For decades, the shelf was treated as the endpoint of planning. Plans were built upstream. Execution was evaluated downstream. When results fell short, the shelf was where problems were discovered, often too late to recover.

In 2026, that model begins to invert.

Retailers are increasingly anchoring execution decisions to observable conditions because it reduces uncertainty and speeds response. When action is grounded in what shoppers actually see, priorities become clearer. Teams spend less time reconciling and more time correcting issues while they still matter.

The shelf stops being a reconciliation point and becomes a reference point.

What This Means for Retail Operating Models in 2026

This shift changes more than task lists. It changes how operating models should be designed.

Retail operating models in 2026 will increasingly favor:

- Fewer signals with higher confidence

- Earlier intervention instead of after-the-fact explanation

- Prioritization that reduces cognitive load for store teams

- Faster movement from signal to action

This matters in an environment where labor remains constrained and expectations remain high. Every minute spent verifying is a minute not spent serving shoppers, coaching teams, or improving execution.

The retailers that perform best in 2026 will not be the ones with the most dashboards. They will be the ones with the clearest standards for what earns attention and the strongest discipline in turning insight into action.

Focus Turns Visibility Into Performance

Visibility alone does not improve execution. It creates the potential for improvement.

The difference is:

- Focus.

- Clear objectives.

- Trusted, decision-grade signals.

- Operating norms that allow teams to act without constant debate or repeated verification.

That is the retail reset heading into 2026.

The advantage is no longer seeing everything. It is seeing clearly, focusing decisively, and turning insight into action on the sales floor.

📄 Download the Digital Teammate Fact Sheet (PDF)

Schedule a Live Demo!

About Badger Technologies

Badger Technologies, a product division of Jabil, is a leader in retail automation and artificial intelligence solutions. Its autonomous robots and digital teammates help retailers improve on-shelf availability, pricing accuracy, planogram compliance, and store safety.

With deployments across grocery, building supply, and other high-SKU retail environments, Badger Technologies provides retailers with real-time data and actionable insights that drive measurable results. Headquartered in Nicholasville, Kentucky, the company is committed to helping retailers build smarter, safer, and more efficient stores.