RFID in Retail: The Tipping Point is Near

For the better part of two decades, RFID (Radio Frequency Identification) has hovered on the edge of retail transformation — promising real-time inventory visibility, automated checkout, and unprecedented supply chain efficiency. Yet, despite headline-grabbing deployments by giants like Walmart and Zara, many wonder: When will retailers fully adopt RFID?

Adoption is accelerating, particularly among large retailers and in specific product categories. "Full adoption" could happen sooner than expected as early indicators of value obtained become more visible.

Leaders are Setting the Pace

Retailers like Walmart, Decathlon, and Inditex (Zara's parent company) have already proven RFID's value at scale. Walmart’s recent expansion of RFID mandates beyond apparel into electronics and home goods signals the technology’s growing footprint. These companies are leveraging RFID not just for inventory tracking but also for improved shelf availability, loss prevention, and a more seamless omnichannel experience.

Adding to this momentum, companies like Badger Technologies are amplifying RFID's potential through autonomous in-store robots. Badger Technologies’ robots, equipped with RFID readers and computer vision, can roam store aisles to perform real-time inventory tracking, price verification, planogram compliance, and even hazard detection. Their ability to autonomously and consistently capture store data minimizes the need for manual audits and improves operational efficiency—making RFID-driven insights more actionable and scalable, especially for retailers facing labor shortages.

Should Mid-Size or Specialty Retailers Delay?

For mid-sized retailers and specialty stores, there are several perceived barriers. The costs of tags, readers, and integration with existing inventory systems can be daunting — especially when margins are tight. Badger Technologies’ solution helps break down some of these barriers. The affordable, Next-Generation robot extends it value by offering RFID sensing capabilities to achieve deeper inventory management insights. As the cost per unit of RFID tags continue to decline (now often below 5 cents per tag in bulk), achieving value from the data these tags provide is more tangible.

Operational complexity is another perceived hurdle. Integrating RFID into legacy systems can be made easier with a flexible API. Leveraging mobile autonomous robots reduces the impact to retrain staff as the solution works alongside teammates to provide real time or near real time insights. And for smaller retailers, the ROI case, which appears to be less compelling without the scale advantages of big-box players, can be achieved with affordable, multi-function solutions.

The Cost of Waiting

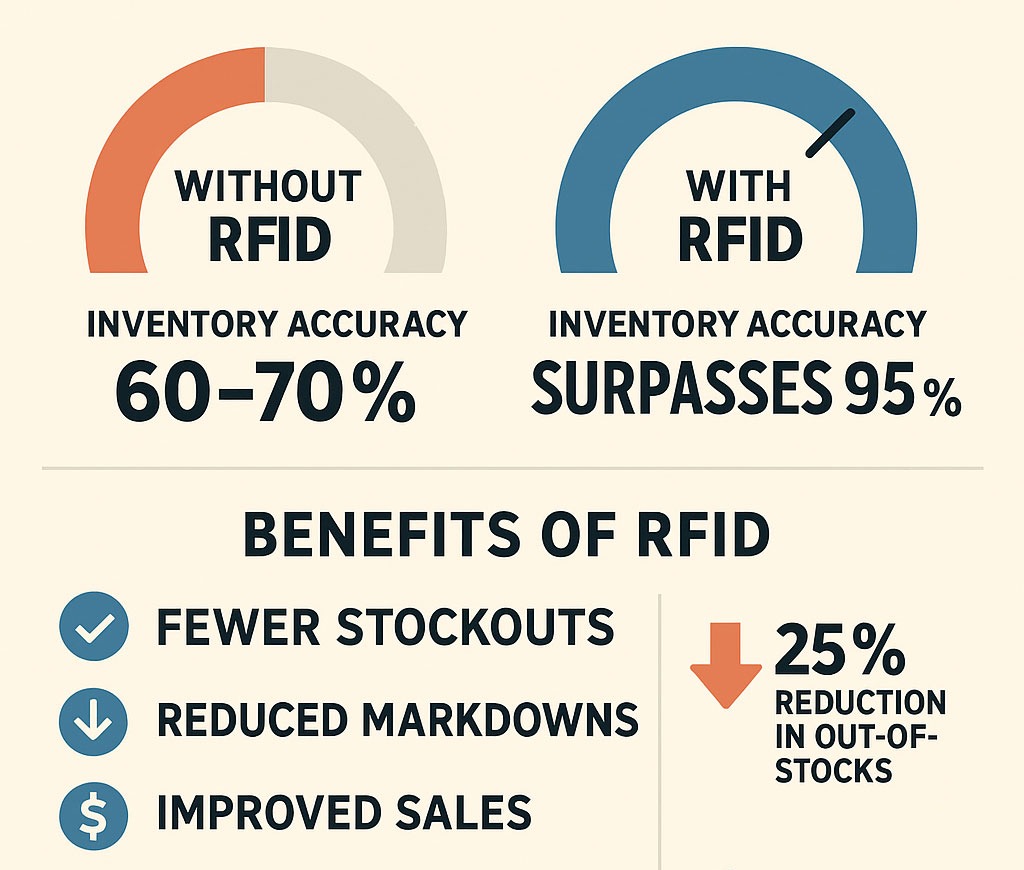

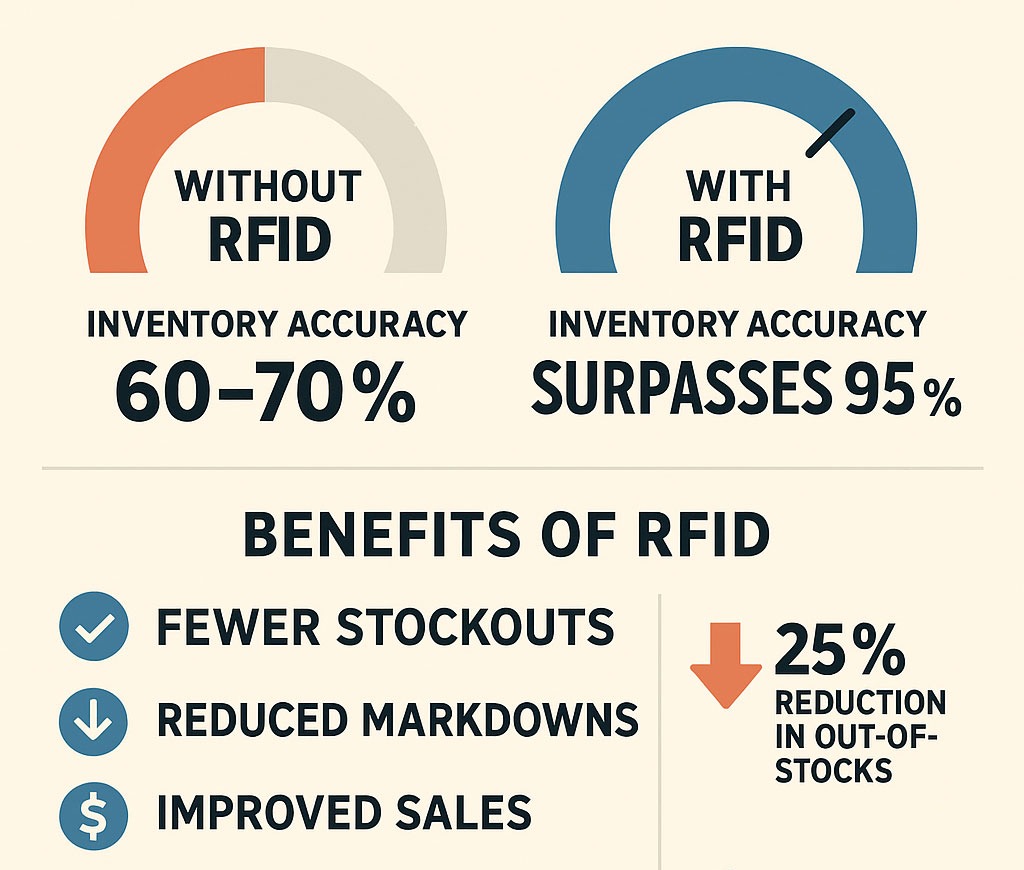

Yet, the longer retailers hesitate, the more value they leave on the table. Without RFID, inventory accuracy typically hovers around 60–70%. With RFID, that figure often surpasses 95%, leading to fewer stockouts, reduced markdowns, and improved sales. According to Auburn University’s RFID Lab, retailers using RFID experience a 25% reduction in out-of-stocks and a 15% reduction in inventory-related labor costs due to improved inventory accuracy and product availability.

Retailers slow to adopt risk higher labor costs for manual inventory counts, missed sales due to inaccurate stock data, and diminished customer satisfaction in omnichannel environments where "buy online, pick up in store" hinges on real-time inventory visibility.

Early adopters are already leveraging these advantages to streamline operations, reduce shrink, and increase profitability. For laggards, the competitive gap will only widen. Technology partners like Badger Technologies further amplify the benefits of RFID by automating routine tasks, enhancing data collection, and enabling faster decision-making — making it even harder for late adopters to catch up.

Factors Accelerating the Shift

Despite these challenges, the trajectory is clear. Rising labor costs are making automation increasingly attractive. The demands of omnichannel retail — where accurate, real-time inventory data is no longer optional — are pushing more businesses toward RFID solutions. Product origin and expiry information can be imbedded in these tags – which provide insight to when product can aid in pricing strategies that prevent waste or aid in product recall inquiries. Perhaps most importantly, the cost curve for RFID hardware and software continues to bend downward, making it accessible to a broader range of retailers. Innovations from companies like Badger Technologies are making RFID more dynamic and operationally feasible, even for stores with complex layouts and high product turnover.

A Realistic Timeline

So when will we see ubiquitous RFID adoption?

- By 2025–2030, expect widespread use among large and mid-sized retailers, particularly in sectors like apparel, electronics, footwear, and cosmetics.

- Full saturation — where even small retailers and less RFID-friendly product categories embrace the technology — timing may be sooner as the value attainment is expedited.

The Bottom Line

RFID’s tipping point in retail is undeniably near. However, "full adoption" will be an incremental, category-specific journey that could move faster than expected. For retailers, the question is not if RFID will become essential — but when it makes sense to invest, scale, and innovate with it.

Those who move early, like Walmart and Zara, are already reaping competitive advantages. With solutions like Badger Technologies’ autonomous robots enhancing RFID’s capabilities, the benefits of early adoption are growing even more compelling. The rest of the industry would do well to watch closely, recognize the mounting opportunity cost of delay — and prepare to follow sooner than they might expect.